Unlock Marketing Efficiency with Vendor Scoring

Chris Golec

Chris Golec shares three key lessons for accurately measuring vendor performance in B2B marketing.

Sales challenging marketing performance and then marketing blaming vendors happens way too often. One of the reasons I founded Demandbase with a focus on marketing to the accounts sales should be selling to (a.k.a. ABM) is because the leads were, in fact, weak! Marketing simply was not paying attention to the quality of the accounts (back in 2007), nor did they understand what a waste of effort it was for a salesperson to spend time with someone that works at a company that will literally never buy anything. Fast forward 17 years, as account-based marketing (ABM) has become more widely adopted, marketers have realized that ABM technology alone is not going to save the day and figuring what is working and how to predictably and efficiently exceed pipeline targets remains a struggle.

Marketers should be continuously asking themselves “how can my organization be more efficient at B2B marketing and maximize our impact on pipeline with every dollar of investment?” Or more simply, where should I invest my next $10,000 or where can I save $10,000 and impact the pipeline the least?

A.I. will soon transform how we answer these questions and make investment decisions in marketing, but the data building blocks to ‘learn’ from must be in place first. At Channel99, we recently introduced vendor scoring functionality for B2B marketers. I am not here to say any single vendor is better or worse than the other, but can say with confidence that it is all about the audience, segment, or the target list of accounts.

Here is what I have learned so far over the last thirty days:

1) KPI’s to measure performance are critical

I understand that B2B marketers want top-of-funnel clicks and visits and will probably continue to invest billions in paid search even though less than 10% of the people clicking are from accounts that have the potential to turn into pipeline. But marketers love volume and its human nature to embrace the instant gratification of new visitors. But performance KPI’s have to be expanded from volume of visits to include quality, $ efficiency and the contribution to building pipeline. If your company still bonuses based on MQL goals, I hope your CMO is reading this blog.

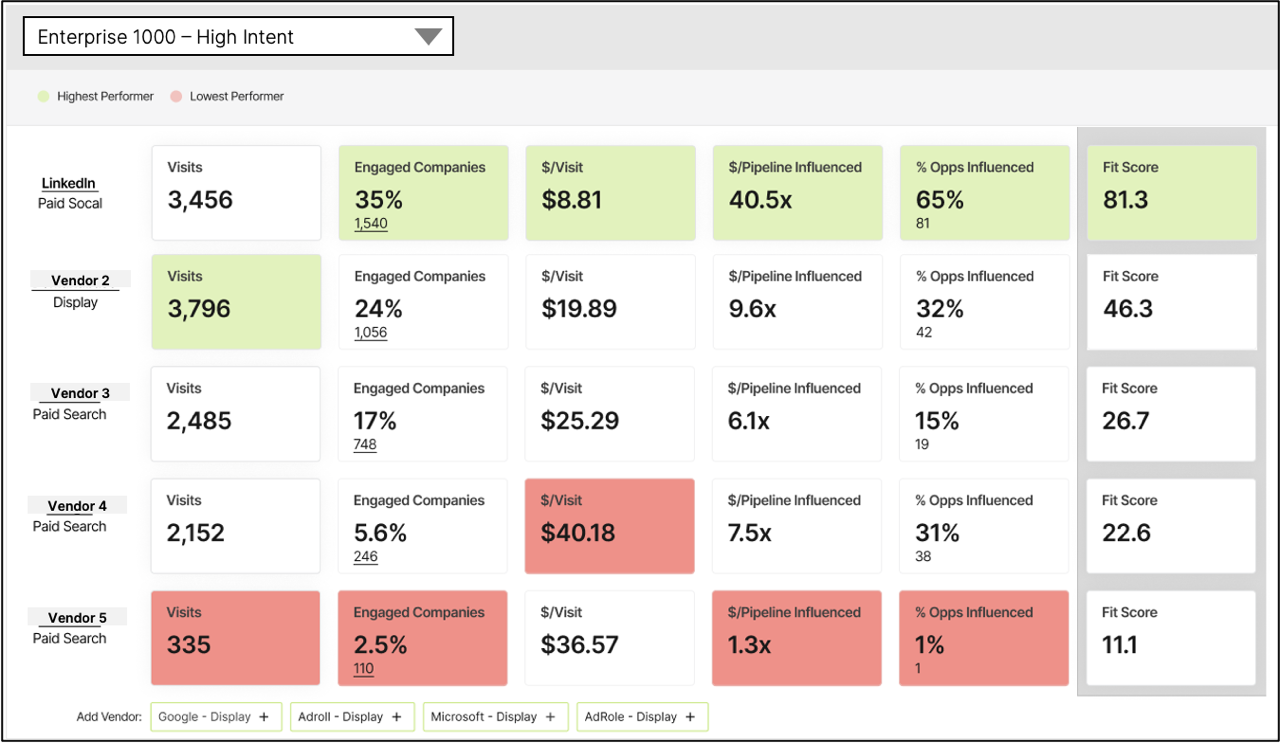

This illustrative example summarizes a scenario comparing LinkedIn paid social ads to other display programs as well as paid search. Results are all unified at the account level, tied to pipeline impact and filtered for a custom audience or target list of accounts. Each of the measurements is then force ranked to broadly understand how well a vendor performs for a given audience relative to the other selected vendors. The “Fit Score” is simply an equal weighting of all the KPI’s to demonstrate how effective a vendor performs in comparison. Changing the audience, or selecting different vendors, dynamically changes the results. No more guesswork and a solid foundation for shifting investment. Almost…

2) Vendor performance depends on the audience and “fit”

I always used to think that ABM technology would outperform all display mediums for B2B. Much to my dismay, it’s simply not true. The data shows that some audiences or account segments are simply better served by social programs or even consumer-tech that is not traditionally built for B2B. For example, I was recently reviewing a customer’s campaign results and they were quick to judge vendor performance based on pipeline and spend. While that is a good place to start their assessment, I drilled into the audience and discovered the audience was so broad and included non-profits with less than $10M in revenue to $1B+/yr global enterprises. Turned out that certain vendors had a hard time reaching accounts under $50M, but were highly cost efficient reaching and engaging larger companies and ultimately converting them into pipeline. Really important to select the right vendors based on the accounts you are trying to reach and engage. For example, marketers may find an SMB audience better served by Facebook Ads or LinkedIn where account identity is known using first-party data, versus an enterprise audience might be more $ efficient to reach and engage using an ABM technology.

3) Consider changing the audience before changing the vendor

It’s always helpful to drill down into the details of poorly performing programs and understand if there is any ‘goodness’ being hidden by skewed results. In the example above, the overall results didn’t meet their intended goals because the audience was too broad for any single vendor. Upon splitting the audience in segments better suited for each vendor, the customer was able to increase the overall efficiency of multiple vendors and dramatically improve pipeline impact. Key takeaway is that vendor performance is highly dependent on the make-up of the audience and further segmentation will likely be an easier/faster path to success.

Important to emphasize that ABM and B2B marketing in general is very inefficient and difficult to execute with significant waste. Reason is that most company’s addressable market is less than 2-3% of companies in existence and the majority of marketing technologies simply do not yet offer tight audience controls at an account level. So it’s upon the marketer to pinpoint the inefficiencies and continuously take action.

If you’re a B2B marketer and want to explore vendor performance for your own target account list, simply create a free account at www.channel99.com, upload your target account list or lists, and connect your media platforms. You’ll be able to start making improvements in days!